estate tax exclusion amount sunset

You can gift up to the exemption amount during life or at death or some combination thereof tax. Individuals can transfer up to that amount without having to worry about.

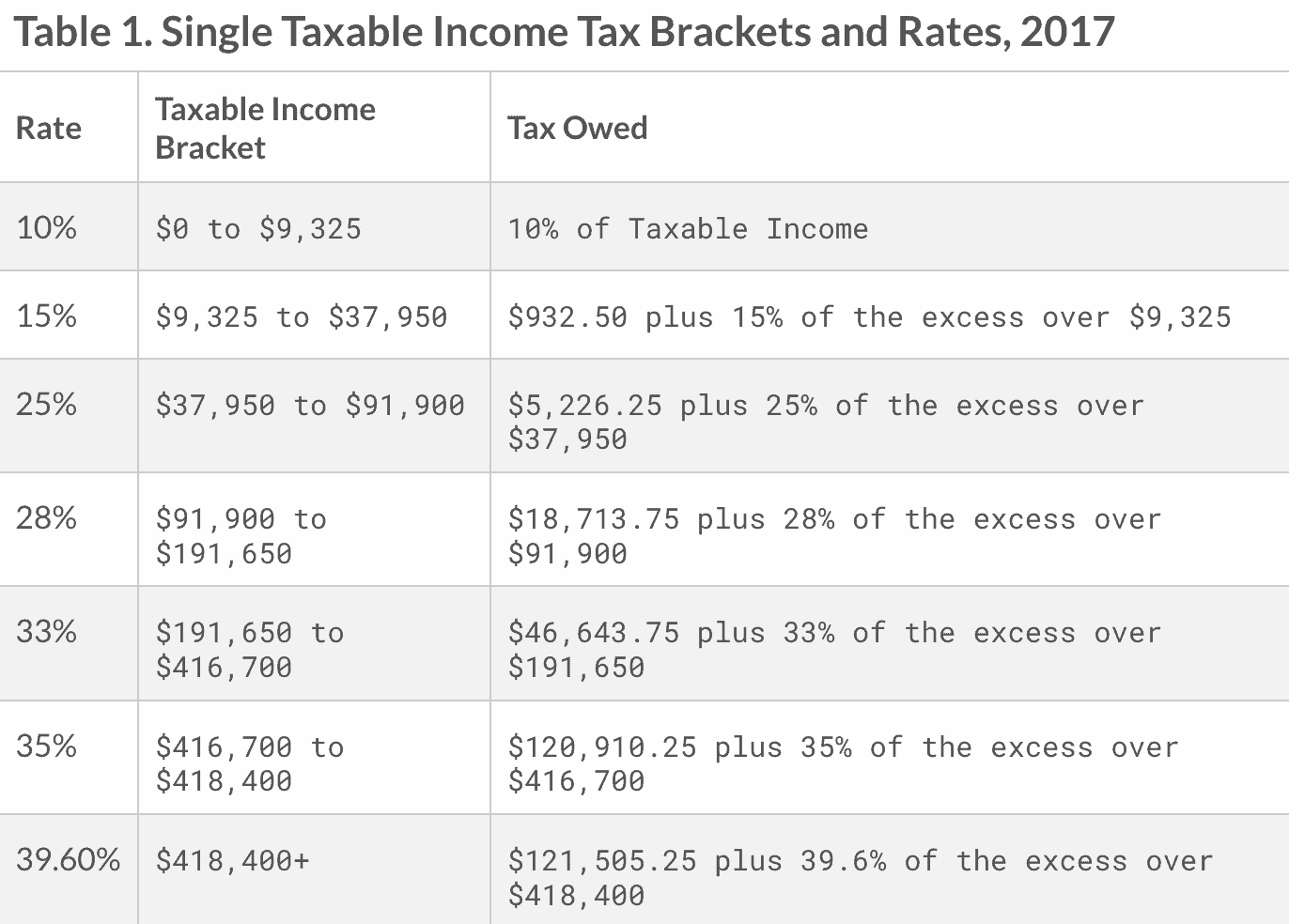

Individual Income Tax Update Presented By Ken Oveson Cpa Ppt Download

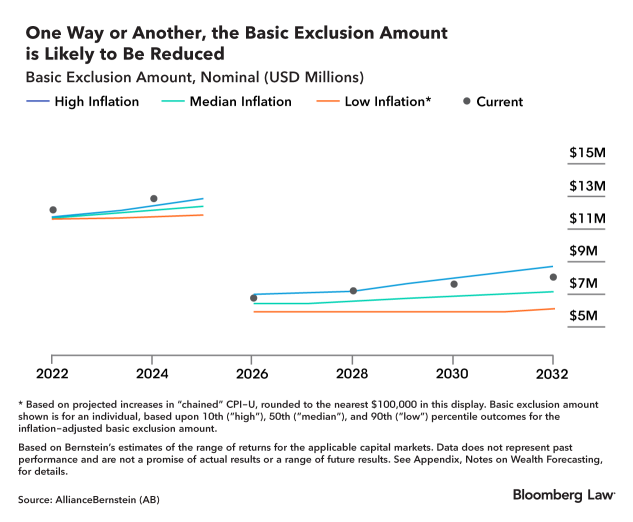

However the TCJA will sunset.

. The exemption amount is compounded annually by an inflation factor. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

Sunset beginning January 1. The current estate tax exemption is 12060000 and double that amount for married couples. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

Under current law the estate and gift tax exemption is 117 million per person. Because the exclusion amount is back to 115 million your estate tax is 46 million. Fast-forward to 2026 and the estate and gift tax exemption.

The first 1206 million of your estate is therefore exempt from taxation. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action.

For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. Fast-forward to 2026 and the estate and gift tax exemption. Federal Estate Tax.

On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when. Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. With certain limitations California.

In 2025 you and your spouse give 115 million to your heirs and file a gift tax return. Californias Proposition 58 which grants the ability to avoid property value reassessment on inherited real estate went in to effect on November 6 1986. This basic exclusion amount is 186 percent of the 14 million exclusion amount allocable to those gifts with the result that 1031519 0186 5545800 of the amount.

For example for 2018 the basic exemption amount was 134706. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less. 24 Upon the death of a taxpayer the estate tax is imposed at a rate of 40 on any portion of his or her gross estate that exceeds 1206 million but this exemption amount can.

This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the. Low-Income The low-income exemption also. 1 You can give up to those amounts over.

Number of Inherited Properties Likely to Grow. The federal estate tax goes into effect for. Notably the TCJA provision that doubled the gift.

The federal basic exclusion amount for estate gift and generation skipping transfer tax purposes was 11700000 per person in 2021. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 How Much It Is And How To Calculate It

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

The Generation Skipping Transfer Tax A Quick Guide

Heirs Inherit Uncertainty With New Estate Tax The New York Times

Four More Years For The Heightened Gift And Tax Estate Exclusion

Qtip Trust Will My Spouse Get What They Need Wilson Law Group Llc

Insights Blog Intrust Advisors

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

How To Navigate Us Estate Tax Ey Uk

The Federal Gift And Estate Taxes Ppt Download

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

The Stretch Ira Strategy Is Largely Gone Here Are 5 Alternatives To Consider Barron S